Points To Remember Health Insurance For Senior Citizens

Health insurance is nothing but a future protective cover in case of any medical emergencies. It is very much essential for everybody and especially senior citizens as they are prone to be infected and affected by illness due to the age factor.

Points To Remember:

Individual Policy: I would suggest that it would be a wise decision to opt for an individual policy rather than include the senior citizens in the family floater plan.

As the severity of claims actually varies for the elderly people.

So, if the senior citizens are included in the plan which is a family floater plan, the premium will be calculated keeping in mind the oldest member of the family.

And so, it would be a smarter decision to make their plan an individual plan and not go for family plans that are available.

Go For Regular Plan:

A smart move would be to go for a regular plan before turning 60 as the premium is high for senior citizens.

There are specialized plans which are designed for those who never obtained a policy until they turned 61.

Due to lots of sub limitations where the payment amount that would be paid by the insurance provider will have limitations and co-payments, wherein the insurer has to pay for some of the expenses along with the insurance agency. The health insurance plan for senior citizens is very much restrictive in nature.

Premium Difference With Respect To The Age:

As the age rises, the premium rate increases too.

It has been proved that there is a 40% to 55% premium difference between a younger person and a senior citizen who is above 60 years of age.

Minimum Insurance Amount Being 5 Lakhs: Due to the increasing inflation in the medical field, that can be medicines, hospital costs if admitted, etc., the minimum insurance coverage amount starts from Rs. 5 lakhs for senior citizens.

Waiting Period: There are lots of restrictions for the senior citizens and one of them include a waiting period for certain diseases. The waiting period ranges from 1 year to 4 years.

Make the Policy Transparent: Due to the above-mentioned facts, it is advisable for those taking a policy under senior citizens age group, to make the policy transparent, so that there are no catches anywhere in the future. Talk to the insurance agent or the advisor before accepting the policy. As this might lead to problems and troubles in the future.

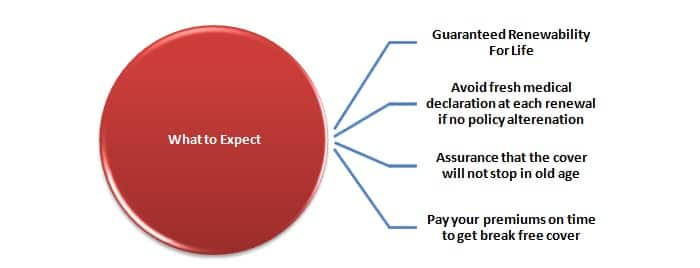

Renewal of Policy: When we renew our policy, there is a chance of the premium rate to increase and this is a common phenomenon. Senior citizens should be made aware of it as they would be relying on their pension amounts to pay the premium.

Wrapping It Up

Therefore, it is highly advisable that a person insures himself/herself at a young age so that the premium rate would be minimal and the waiting period would be over by the time they age and hence would avail the benefits of the insurance. Be smart and insure yourself today!!!!